September InsightsThere's time for one more wave before saying so long to summer and kicking into high gear for fall! Here's what to know and everywhere to go this month.

25 Designs That Shape Our WorldSome designs are smart. Some designs are beautiful. Some designs are instantly ingrained in our lives. It’s the rare design that combines all three qualities, but the editors at Architectural Digest have managed to compile a list of buildings, objects, and innovations that do just that. See all of them here. Coming Soon!© Compass 2019 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a real estate broker licensed by the State of California operating under multiple entities. License Numbers 01991628, 1527235, 1527365, 1356742, 1443761, 1997075, 1935359, 1961027, 1842987, 1869607, 1866771, 1527205, 1079009, 1272467. All material presented herein is intended for informational purposes only and is compiled from sources deemed reliable but has not been verified. Changes in price, condition, sale or withdrawal may be made without notice. No statement is made as to accuracy of any description. All measurements and square footage are approximate. Equal Housing Opportunity.

1 Comment

July Insights July has arrived and alongside it all the best that summer has to offer. Enjoy! This program helps you sell your home faster and for more money by covering the cost of services to prepare your home for market and increase its value. Tips & Tricks

Local Events

Featured Leases

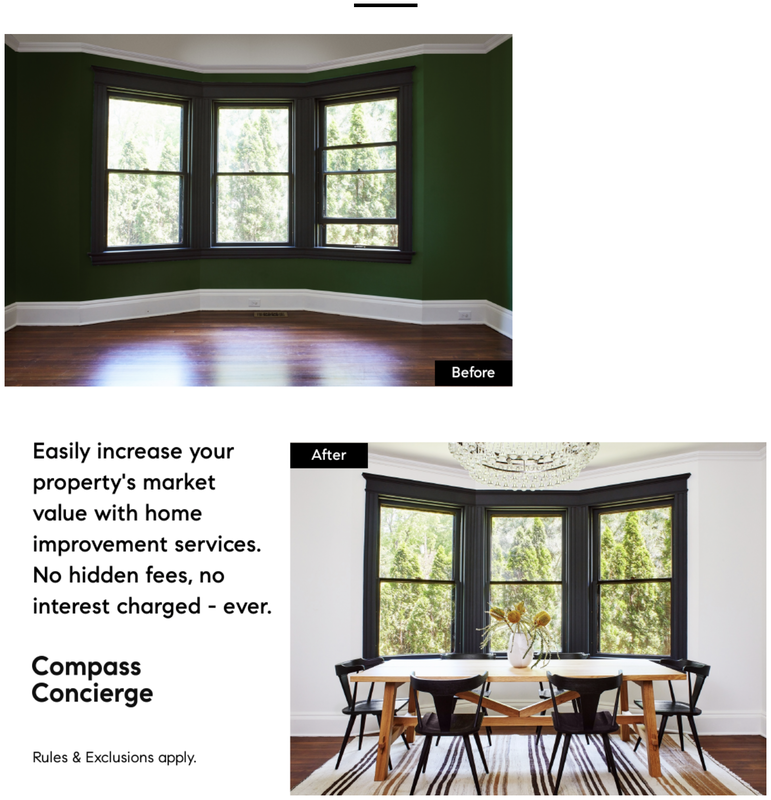

CompassEasily increase your property's market value with home improvement services. With this only-at-Compass offering, we'll front the cost of services to improve your home for a quicker, more profitable return. No hidden fees, no interest charged — ever.  Compass will cover all upfront costs, collecting payment for the services rendered at the time of the property's closing. By investing in your home's potential, we aim to provide a swifter, more profitable sale.  Services include: Staging Deep-cleaning Cosmetic renovations Decluttering Landscaping Painting Pest control Custom closets Curious to learn more? Contact me to discuss how Compass Concierge could help you. Rules & Exclusions apply. Home Must Qualify under Compass Concierge guidelines. Upfront cost will be repaid out of the proceeds of the sale. CompassJUNE INSIGHTS Finally, the moment we've all been waiting for: SUMMER! And with it, longer days, warmer weather, and more excuses to get together. Check out 40 EPIC SUMMER PARTY IDEAS. LOOKING FOR AN ENDLESS SUMMER? Ayada Maldives is one of the most stunning island resort experiences in the world with direct access to over half a dozen world-class surf breaks. The Island has a variety of bungalow options with private beach villas to iconic overwater bungalows. Doesn't get any better than this...! Read more

Janet Yellen’s final meeting as Fed Chair was last week. The Fed decided not to raise rates. Jerome Powell assumes the position on February 3d. Expect a rate hike in March and probably 3 more in 2018. The days of cheap money are coming to an end!

Today, if you’re borrowing to finance the purchase a single family residence from a commercial bank, you can lock in an interest rate (15 year fixed) of 3.387% or refinance at 3.51%. Want a home equity loan (HELOC)? 3%, which is up .79 from a year ago. Hard money for “flips” is still at 8.5%. These rates are very attractive, with market values increasing 8% to 10% per year. Why will the Fed increase rates, which will cause banks to increase borrowing costs? Remember – Low rates resulted from the Fed’s decision to stimulate the economy by dropping the Fed Funds rate to 0% in 2007-2008. Today, the gains in employment are at 17 year lows – 4.1%. Household spending and capital investment are anticipated to increase because of the recent tax cuts. Therefore, labor markets will get stronger and the economy will expand. So, the enemy is inflation – check that by increasing interest rates. Our advice is to lock in interest rates in the next 60-90 days. If you’ve been contemplating selling your Malibu home, stop procrastinating and sell it now. For a number of reasons, the seller’s market could not be hotter.

Demand is very high. The DOW hit a record high in December – it was up 25.1% in 2017, while the S&P was up 19.4% and the Nasdaq 28.2%. People feel wealthy and liquid and the Tax Bill causes the affluent to be optimistic about their future. Supple is historically low. As of year end, there were only 53 beachfront and 118 landside homes available for sale – a total of 161 homes. The norm is 250. So available home inventory is down 35%! Tht puats upward pressure on prices, which is great for buyers. Interest rates are still at historically low levels. With 25% to 30% down, buyers can borrow the balance at 3.5% to 3.75%. That’s very attractive as many borrowers can earn more that their cost of funds. Please call us so we can help you optimize the price of your home and sell it for you while the market stays hot. TAX REFORM: Some Facts and OpinionsI have been a registered Independent for over 40 years. Although I voted for President, I did not vote for Trump or Clinton. I believe I am without bias.

I was Attorney-Advisor for Tax Policy to Treasury Secretary Simon during the Nixon Administration a Chair of the Tax Department at the 1200 attorney Paul Hastings law firm. I know a little about taxation and tax policy so I want to take this opportunity to objectively provide some thoughts on Tax Reform. Tax Reform legislation will probably be enacted before year-end. It’s a very complicated (500 pages) transformational law – one that completely reshapes the tax code for the first time since 1986. As a Republican revision – it will probably pass the Senate with 51 or 52 Republican votes and no Democratic votes. No normative judgment, just the facts. Public support at 32% seems low. That’s the same percentage as Trump’s approval rating. One reason might be that the legislation does very little for the “middle class,” with 62% of the economic benefits going to the top 1% of wage earners. In 2018, tax savings will be low for most people - $1,000 to $2,000 – for the year. By 2019, the vast majority of people earning $200,000 or less will see their taxes increase. 6 of the 7 tax brackets will be lowered (including the top bracket from 39.6% to 37%) and the standard deduction doubled from $1,200 to $2,400, which will reduce the number of people itemizing their deductions from 19% to 5% thus “simplifying” the tax code. However, the “caps” on the deductibility of State and local taxes will offset the savings for individuals ($10,000), property taxes ($10,000), and mortgage interest ($500,000). Individuals aside, corporate taxpayers will benefit from the tax rate reduction from 35% to 21%. This will create an “asset bubble,” as many large corporations are already cash rich from earnings and borrowing is historically inexpensive. The lower rates will dramatically facilitate the repatriation of warehoused earnings from abroad (eg. Ireland). One provocative question is the deployment of this multi-trillion dollar hoard of capital. Will corporations reinvest it to expand business activities; raise wages; buy back stock; raise dividends; etc? And, why didn’t Congress take this opportunity to incentivize monetization to “Make America Great Again.” What use will do the most good? Whatever your view on the above, Tax Reform has a cost. The estimates are between $1.5 and $2.4 Billion over the next 10 years, assuming the temporary benefits are allowed to expire. Just like the Bush cuts in 2001 and 2003, the will not expire. According to the Congressional Budget Office, the national public debt is at $15 Trillion. That’s 77% of gross domestic product. Think about that. What if 3/4th of your pre-tax earnings went to pay your bills? Most people would not have any net income. My opinion, for what it’s worth, is that this is a very bad law. |

Details

AuthorA majority of the articles are written by real estate experts Bill Chadwick and Brenda Hayward. Archives

September 2019

Categories |

|

Hours

M-F: 9am - 5pm DRE#01502468 DRE#01994555 |

Telephone

310-924-5352 310-990-5510 |

RSS Feed

RSS Feed